Nonetheless, estimates indicate Chanakya doubtless generates over Rs 500 crore annually from its HFT and market-making actions. The firm actively trades on NSE, BSE, and MCX using good order routing and proprietary execution algorithms. Wanting ahead as HFT grows more pervasive, calls for safeguards towards volatility and disruption are rising globally. Strict “speed bumps” might be imposed to curb extreme transactions. However, any coverage actions should weigh advantages in opposition to prices to avoid over-regulation. The goal must be optimizing stability while encouraging financial innovation.

High-frequency Trading (hft): Definition, Origin, Methods, Return, Laws

Filippo makes a speciality of the most effective Foreign Exchange brokers for newbies and professionals to help merchants discover the best buying and selling options for his or her wants. He expands his evaluation to stock brokers, crypto exchanges, social and duplicate trading platforms, Contract For Difference (CFD) brokers, options brokers, futures brokers, and Fintech merchandise. The risks of High-frequency buying and selling embody market volatility, systemic disruptions, and regulatory challenges. In addition to regulatory and ethical considerations, the disciplined use of a stock buying and selling journal is essential for high-frequency merchants.

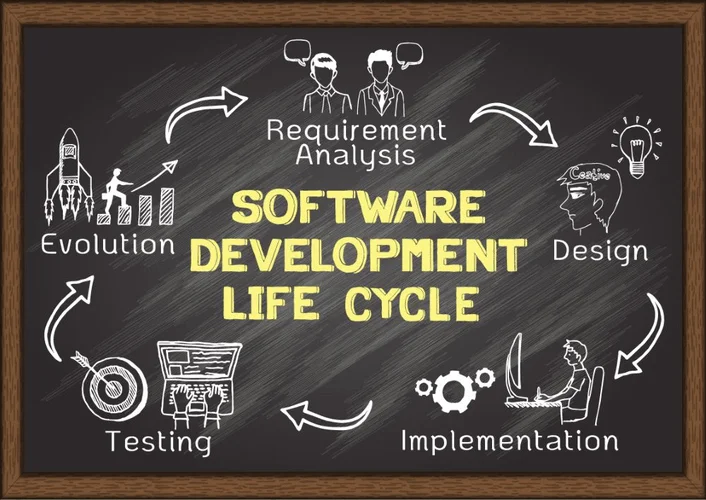

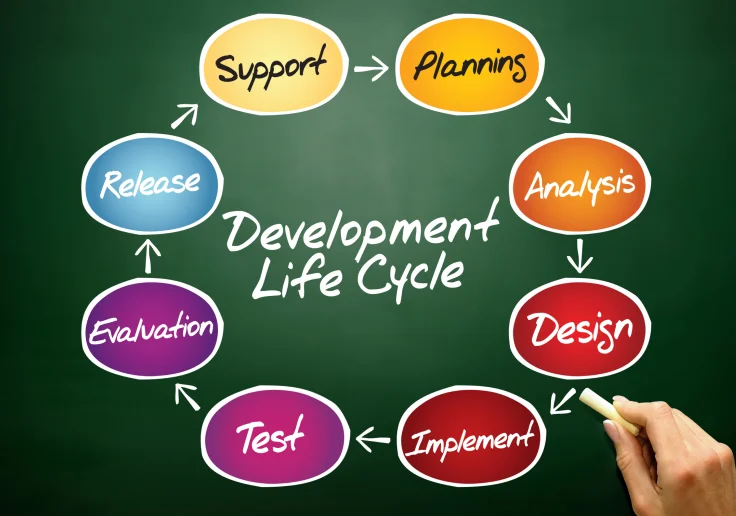

How High-frequency Buying And Selling Works

High-frequency trading (HFT) works by using sophisticated algorithms and high-speed connections to quickly commerce securities in the monetary markets. HFT firms make the most of advanced applied sciences and infrastructure to execute massive numbers of orders at extraordinarily excessive speeds measured in milliseconds, microseconds, or even nanoseconds. In the 2000s, high-frequency buying and selling expanded to other asset lessons past equities. Futures, foreign exchange, and fixed-income markets saw a rise in HFT as exchanges moved to digital buying and selling methods.

If some HFT agency abuses this feature, it is often identified as “order stuffing”. Based Mostly on pre-set logic, strategies and machine studying fashions, the algo system is prepared to determine if and when to put a trade. When building an HFT system, consider how to make it fault-tolerant and scalable. A subtle system should deal with many types of failure without disrupting its operations. Malicious agents in high-risk situations could cause DDOSes by disrupting market entry for others.

Skilled merchants use algorithms to get an edge over their competitors. These algorithms help professional merchants earn revenue from sudden changes in inventory costs. The goal is to make small earnings from tiny value movements that occur in the market. To do this, HFT relies on complex laptop algorithms and advanced expertise to process and react to data in real-time. The use of know-how in stock markets has revolutionised the entry and the mode of investing and buying and selling for an average Indian. This also prompted the usage of know-how for the execution of fast trades in excessive frequency that can be instrumental in building a profitable portfolio.

- News-based trading seeks to capitalize on important announcements that influence asset costs before human merchants react.

- Market Information IngestionHFT methods get a stream of real-time information from the change.

- High-frequency buying and selling (HFT) is a type of automated buying and selling that utilizes powerful computers and algorithms to transact a giant number of orders at extraordinarily high speeds.

- In addition, HFT returns have declined over time because the strategy has become more widespread and competitive.

- HFT firms act as market makers by creating bid-ask spreads and churning principally low-priced, high-volume stocks many times daily.

The Components Of Hft Methods

However it can lead to main market moves and removes the human touch from the equation. High-Frequency Buying And Selling (HFT) refers to a kind of buying and selling technique that makes use of superior pc algorithms to execute a giant quantity of trades at incredibly fast speeds. HFT depends on highly effective computers and complicated software program programs to analyze market data, identify patterns, and execute trades within fractions of a second. These trades can contain buying or promoting stocks, commodities, currencies, or different monetary instruments.

The initiator of the entire course of predicts that after the artificially created price movement, it’ll revert to regular, and a place early on can lead to profit. When this apply entails market manipulation, the Securities and Exchange Commission (SEC) has deemed it unlawful. Propriety traders employ many methods to generate income for their corporations; some are commonplace, and others are more controversial. Note that these are all extraordinarily short-term methods, using automated moves using statistical properties that would not give success in buy-and-hold trading. In HFT, good computer programs called algorithms analyze the market and determine when to buy or promote. The objective is to make small income on every trade, which might add up as a result of there are so many trades.

High-Frequency Buying And Selling (HFT) is a robust technique where computer systems buy and promote stocks in milliseconds. This methodology uses advanced algorithms, ultra-fast web, and smart data analysis to make quick income. HFT algorithms are designed to analyze vast amounts of market knowledge in real-time, identifying patterns, trends, and opportunities within milliseconds. These algorithms contemplate factors such as price movements, order guide imbalances, and news sentiment to make rapid buying and selling decisions. HFT corporations utilize sophisticated computational models to investigate market knowledge, detect inefficiencies, and capitalize on worth discrepancies with unmatched speed.

It is also required to take care of logs of every algorithm version and parameter modifications. This will assist in doing an audit in case there are some points or errors in the algorithm. HFT is doubtless considered one of the extremely regulated businesses, and SEBI has robust rules round algorithmic and high-frequency trading. The goal is to make sure fairness, transparency, and market stability while fostering innovation in buying and selling expertise. Most of the HFT methods are proprietary by nature, and hence, the rules of the methods usually are not shared by the companies. This lack of transparency can result in informational asymmetry between the HFT merchants and retail traders.

The bid-ask spread refers again to the difference between what buyers are keen to pay for an asset and what others are asking for. HFT firms can act as market makers, inserting orders at excessive pace and bettering pricing for traders. Advances in know-how have helped many components of the financial trade evolve, including the trading world. Computers and algorithms have made it easier to find opportunities and make trading faster. High-frequency buying and selling permits main buying and selling entities to execute massive orders very quickly. If you’ve ever wondered about high-frequency buying and selling (HFT) and the method it impacts the inventory market, you’re not alone.

Program defensively to limit draw back, significantly throughout market disruptions that will occur. Stress take a look at techniques and set stops to comprise potential losses on errant trades. Guarantee you have the know-how infrastructure to watch danger in real-time throughout portfolios. Risk management separates successful stock market merchants from gamblers. In March 2012, SEBI empowered inventory exchanges to penalize algorithmic merchants for any unfair trade practices. Exchanges have been allowed to take immediate action towards errant algorithmic merchants.

In the beginnings of digital buying and selling within the inventory market, trades had been measured in minutes or seconds. This gradually improved to commerce execution instances measured in milliseconds after which microseconds. The core principle of HFT lies in its capability to execute trades at lightning velocity. By using sophisticated algorithms, HFT traders analyze a number of markets and swiftly execute orders primarily based on market circumstances.

The phenomenon of “spoofing” and “layering” by HFTs has drawn scrutiny. This includes submitting pretend orders to influence market costs after which capitalizing on the subsequent movements. Critics view it as pure manipulation, although proving intent is difficult.

The fast rise of high-frequency buying and selling came into the general public spotlight in the Could 6, 2010, Flash Crash. On that day, the Dow Jones Industrial Common plunged over 600 factors in minutes before rebounding nearly as rapidly. An SEC investigation found that HFT methods exacerbated the decline by rapidly pulling liquidity from the market. This highlighted the risks created by the stock market’s rising reliance on high-frequency traders. Sure, although its profitability varies in numerous market conditions What Is High-frequency Trading, how properly competitors are maintaining with technological advances, and regulatory adjustments.

Most HFT methods assume normal market conditions and relatively steady correlations. Considerably heightened volatility or a breakdown in historic relationships causes models to fail. HFT firms typically lose substantial capital very quickly during times of market stress like the 2010 Flash Crash. To implement these methods profitably at excessive speeds, HFT systems require expensive, specialized hardware like GPUs, FPGAs or ASICs, colocation services, and ultra-low latency networks.

Fibre optic routes between exchanges in New Jersey and Chicago shave very important milliseconds off buying and selling instances. Co-locating company servers instantly next to an exchange’s matching engines supplies microsecond latency advantages. Index arbitrage entails high-frequency merchants concurrently shopping for and promoting the components of an index and the index itself to revenue from temporary pricing inefficiencies between them. Index arbitrage aims to revenue from price discrepancies between an index fund or ETF and its underlying basket of stocks. Alternatives arise around index rebalances when passive funds must buy and promote to match new weights. They trade the overvalued inventory towards the lagging ETF to profit when pricing corrects again to equilibrium.